Layer 1 blockchain TRON, based by Justin Solar in 2018, is main all blockchains in community charges during the last month, surpassing Ethereum, the same old chief, by 28%.

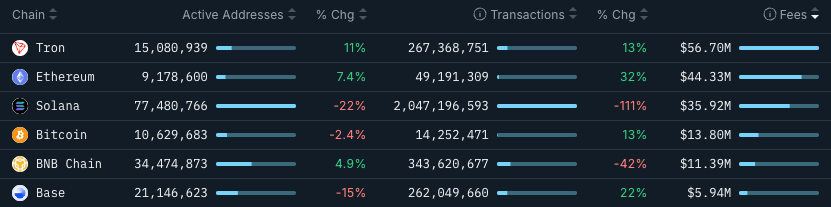

TRON has generated $56.7 million in charges during the last 30 days, fueled by 267 million transactions, whereas Ethereum generated $44.33 million throughout 49 million transactions, in line with Nansen.

Chains by 30-day Transaction Charge – Nansen

Regardless of the large month, TRON nonetheless trails Ethereum and Solana in yearly charges, with $669.5 million in comparison with Solana’s $917 million and Ethereum’s $1.06 billion.

TRON launched a number of integrations in August, together with a collaboration to launch Kraken’s tokenized xStocks on TRON. The TRON DAO attributes the soar in exercise to PayFi firms launching on the blockchain and elevated stablecoin transfers.

“TRON has been prioritizing RWAs, Stablecoins, and bringing extra property on chain…A variety of dApps and protocols run on TRON (DEXs, lending, funds, NFTs), however present charge income is pushed extra by very high-volume stablecoin transfers than by protocol-level DeFi charges alone,” mentioned Sam Elfarra, a group spokesperson for the TRON DAO.

“TRON’s robust share of worldwide blockchain protocol income is pushed by sustained consumer exercise, excessive transaction volumes, and a strong stablecoin ecosystem — all of that are measurable on-chain and mirror the community’s established function in digital funds and settlements,” Elfarra added.

The community has additionally been tapped by the U.S Commerce Division as a vacation spot for safe commerce information, with the company publishing U.S. GDP figures on Tron earlier this month.

Whereas the elevated adoption highlights TRON’s rising presence in the USA, latest drama between Justin Solar and the Trump household’s DeFi venture, World Liberty Monetary, has left a bitter style in some supporters’ mouths.

WLFI Controversy

World Liberty Monetary, co-founded by the President’s son, Donald Trump Jr, surprisingly blacklisted Solar’s onchain deal with that holds greater than 500 million WLFI tokens, value roughly $95 million, after the deal with transferred roughly $1 million in WLFI to centralized trade HTX, probably to be bought.

The blacklist operate basically freezes the pockets’s capabilities with WLFI contracts, however it’s unclear whether or not it will totally forestall token transfers.

Particulars surrounding the transfer stay unclear, however Solar conveyed his dismay on X, saying, “Nevertheless, through the course of operations, my tokens have been unreasonably frozen. As one of many early traders, I joined along with everybody—we purchased in the identical manner, and all of us deserve the identical rights….I name on the staff to respect these rules, unlock my tokens, and let’s transfer ahead collectively towards the success of World Liberty Monetary.”

Neither World Liberty Monetary nor Donald Trump Jr have publicly commented on the matter but.