OKX has launched its thirty second proof-of-reserves report. As of June 14, the full BTC and USDT holdings held in consumer wallets have plummeted considerably in comparison with the earlier month’s report.

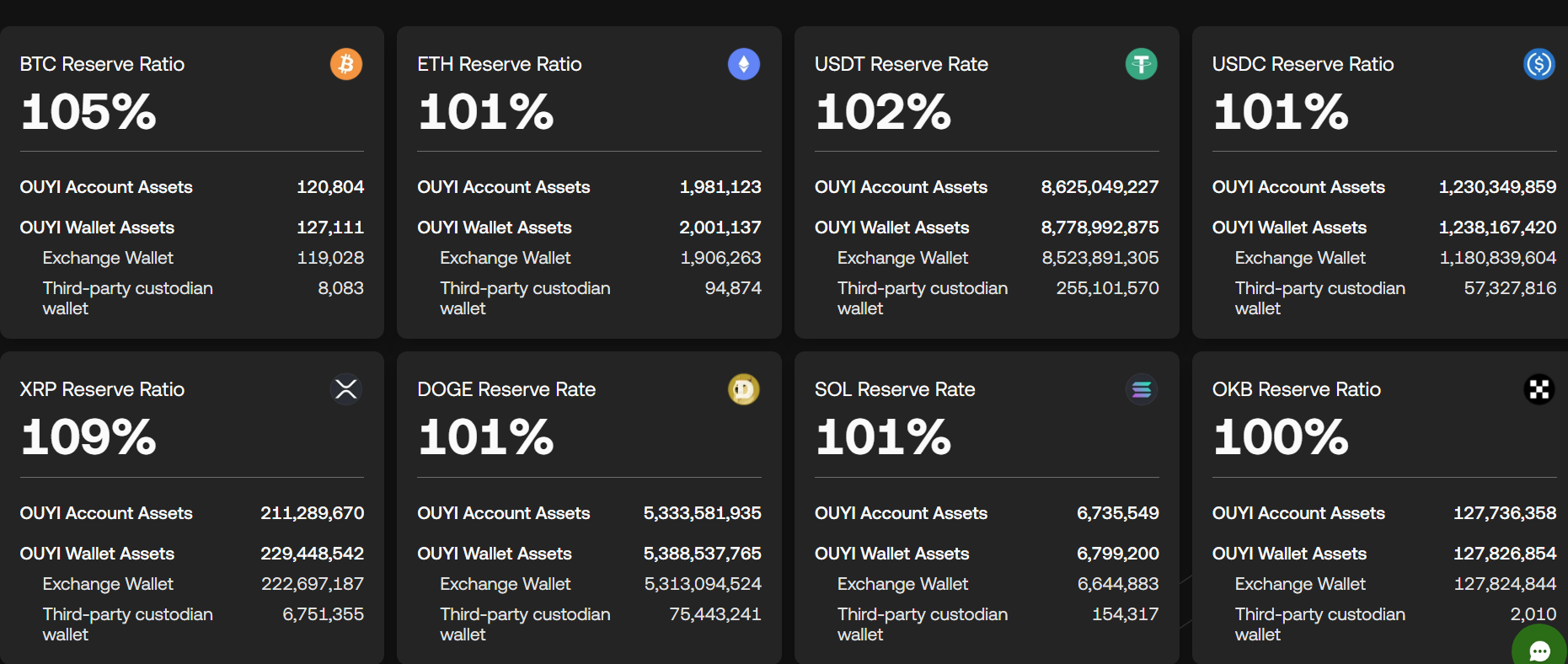

On June 30, the crypto buying and selling platform launched its thirty second proof-of-reserves report containing the variety of property held inside its reserves in comparison with the variety of property deposited by prospects. To this point, all of its reserves exceed the 100% ratio. Which means that the platform’s reserves for main tokens like BTC (BTC), ETH (ETH), SOL (SOL) and USDT (USDT) has surpassed the variety of property held in buyer wallets.

The reserve charge for Ethereum Basic (ETC) holds the biggest ratio, which stands at 107%. In the meantime, Bitcoin stays the second largest asset by reserve to holding ratio, sitting at 105% as of June 14. Nevertheless, the variety of BTC held by prospects has skilled a big drop.

In comparison with the earlier month’s report, particularly for Might tenth, the variety of at the moment held BTC in June has decreased by 4,360 BTC or round $470 million in line with present market costs. In comparison with Might’s buyer holdings for BTC, which stood at 125,164 BTC, the quantity fell by 3.48%.

OKX launched its thirty second proof-of-reserves report on June 30 | Supply: OKX

You may additionally like: OKX publishes proof of reserves with over 100% property held for 22 cryptocurrencies

Except for BTC, USDT additionally fell by 1.44% in June in comparison with the earlier month. Which means that the quantity of USDT held by OKX customers decreased by $126.4 million. Though the decline will not be as steep because the drop skilled by BTC, it’s nonetheless price noting because of the increase stablecoins within the wider market as of late.

Then again, buyer pockets holdings for Ethereum rose by practically 6% in June. This signifies an increase of 110,153 ETH ($272.8 million) within the span of an almost a month. The report reveals that OKX customers have been depositing extra Ethereum into the change in comparison with Bitcoin.

What might the drop in OKX consumer BTC holdings imply?

The three.48% drop in BTC holdings present that customers might have chosen to withdrawn extra Bitcoin from the change in comparison with the earlier month. A potential motive behind this development is the rising variety of merchants eager on self-custody.

Which means that customers may be shifting extra of their BTC to chilly wallets, reflecting rising considerations over change safety or a desire for holding throughout unsure market situations. One other risk is that some merchants could also be buying and selling away their BTC holdings in favor of different property within the wake of latest value actions.

BTC had just lately recovered from its short-lived droop when Trump introduced a ceasefire between Israel and Iran, bouncing again to the $105,000 mark. Nevertheless, the Fed charge determination and different geopolitical uncertainties have induced Bitcoin to flatline for probably the most half.

You may additionally like: Why is crypto down immediately : SOL, XRP and memecoins plummet amidst Bitcoin dominance rise