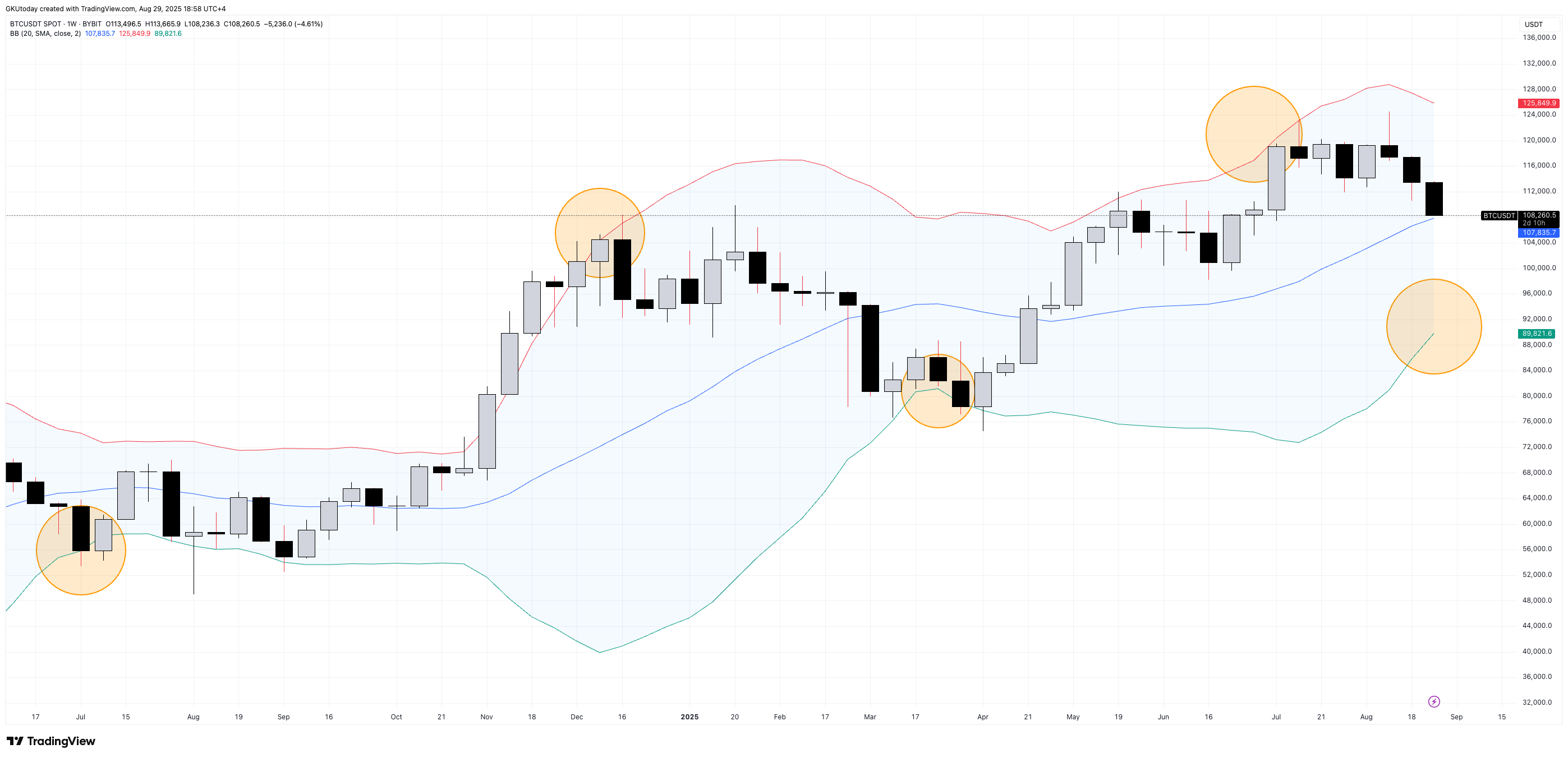

The weekly chart of Bitcoin begins exhibiting warning indicators that might have severe penalties. The Bollinger Bands, specifically, present that the value may drop under $100,000. That could be a line that has been a significant assist degree for the entire crypto market, each technically and in a psychological sense.

The setup is obvious on the one-week timeframe: Bitcoin rejected the higher band close to $124,000 and is now sliding again towards the midline round $107,000. BTC has hit the highest of this channel a number of occasions up to now, and every time, it has dropped after a brief rise.

If the midband doesn’t maintain, the decrease fringe of the construction comes into play close to $88,000, which might imply a lack of the six-figure worth level.

The sample is necessary as a result of it’s constant. Earlier this yr, a dip into the decrease band marked the beginning of a powerful rebound, whereas rejections in March and July signaled prolonged drawdowns.

This newest transfer seems to be quite a bit like these earlier reversals, so it looks as if the market may be getting into a corrective section once more, although there was optimism after the $124,000 peak.

What’s subsequent for Bitcoin?

The skin world is making the state of affairs extra fragile. With Bitcoin, the mixture of technical rejection and macro uncertainty make it extra doubtless that there might be a deeper retreat if patrons can not maintain the $100,000 degree.

For now, the $100,000 line is getting used because the dividing level. If it closes under that this week, it’ll affirm the Bollinger Bands sign and produce consideration to $88,000 per BTC as the subsequent massive factor to observe.