- Ethereum whales acquired virtually 1 million ETH on a single day, which was the most important one-day aggregation since 2018.

- Change reserves stay at multi-year lows, with staking and long-term holding rising.

- A surge above $2,700 may sign a surge in the direction of $4,000; nonetheless, rejection may give rise to a revisit of the two,000 stage.

On-chain knowledge exhibits that Ethereum whales took out virtually 1 million ETH on a day, the most important day by day acquisition since 2018. This huge spike is preceded by an inclination in the direction of elevated confidence amongst buyers regardless of all the present uncertainty available in the market.

Whales purchased practically 1,000,000 $ETH in ONE DAY

The LARGEST day by day purchase since 2018 🚨 pic.twitter.com/zP35rL28zE

— Quinten | 048.eth (@QuintenFrancois) June 18, 2025

As of writing, Ethereum has declined by 2% to shut at $2,533, following a ten% weekly correction. However, the magnitude of this whale hoarding is a sign of a breakout revival.

In accordance with the Glassnode chart, there’s a distinct growing sample in ETH holdings by addresses with 1,000 to 10,000 Ether. These addresses have now totaled roughly 14 million ETH, breaking multi-year loss tendencies.

The transfer comes as staking has not too long ago exploded with greater than 35 million ETH at the moment locked, representing 28.3% of the provision. Strikingly, in June, there have been over 500,000 ETH staked.

Provide Dwindles as Lengthy-Time period Holders Step In

Ethereum reserves on centralized exchanges are at the moment right down to 18.7 million ETH, the bottom since years. This present outflow, which has been witnessed by CryptoQuant knowledge, is an growing long-term holding pattern. The alternate netflows have been unfavorable, and this circulation has been regular, indicating that extra ETH has been leaving exchanges than coming into.

Supply: CryptoQuant

Addresses with no historical past of promoting now management an all-time excessive of twenty-two.8 million ETH. This conduct, coupled with elevated staking and whale buys, signifies diminished promoting strain within the quick time period. When alternate reserves fall whereas worth stabilizes, it usually factors to suppressed sell-side liquidity, doubtlessly setting the stage for a provide squeeze if demand rises.

Supply: CryptoQuant

Breakout Imminent or One other Rejection?

The 50-week exponential shifting common (EMA) is now the main focus, at the moment ranging between $2,650 and $2,700. ETH has repeatedly been unable to create an in depth above this stage. Nonetheless, historic breakouts of this space have led to rallies of 25% to 135%, in keeping with crypto analyst İbrahim COŞAR.

Ought to Ethereum break this mark, a technical forecast signifies that the primary main goal could be on the worth of $4,000. This worth additionally coincides with the higher finish of a long-term bullish flag sample. In an upswing, extra bullish Fibonacci extension ranges are at costs of $5,817 and $8,549.

$ETH Macro Bullish Flag Formation📈

Ethereum has been consolidating inside a large bullish flag since 2021.

Every contact of help has led to a powerful rally, and we’re in that rally part once more.

🔼 Technical breakout goal for $ETH : $8,000

The subsequent growth part might be… pic.twitter.com/yd6UtAshfw

— Bitcoinsensus (@Bitcoinsensus) June 17, 2025

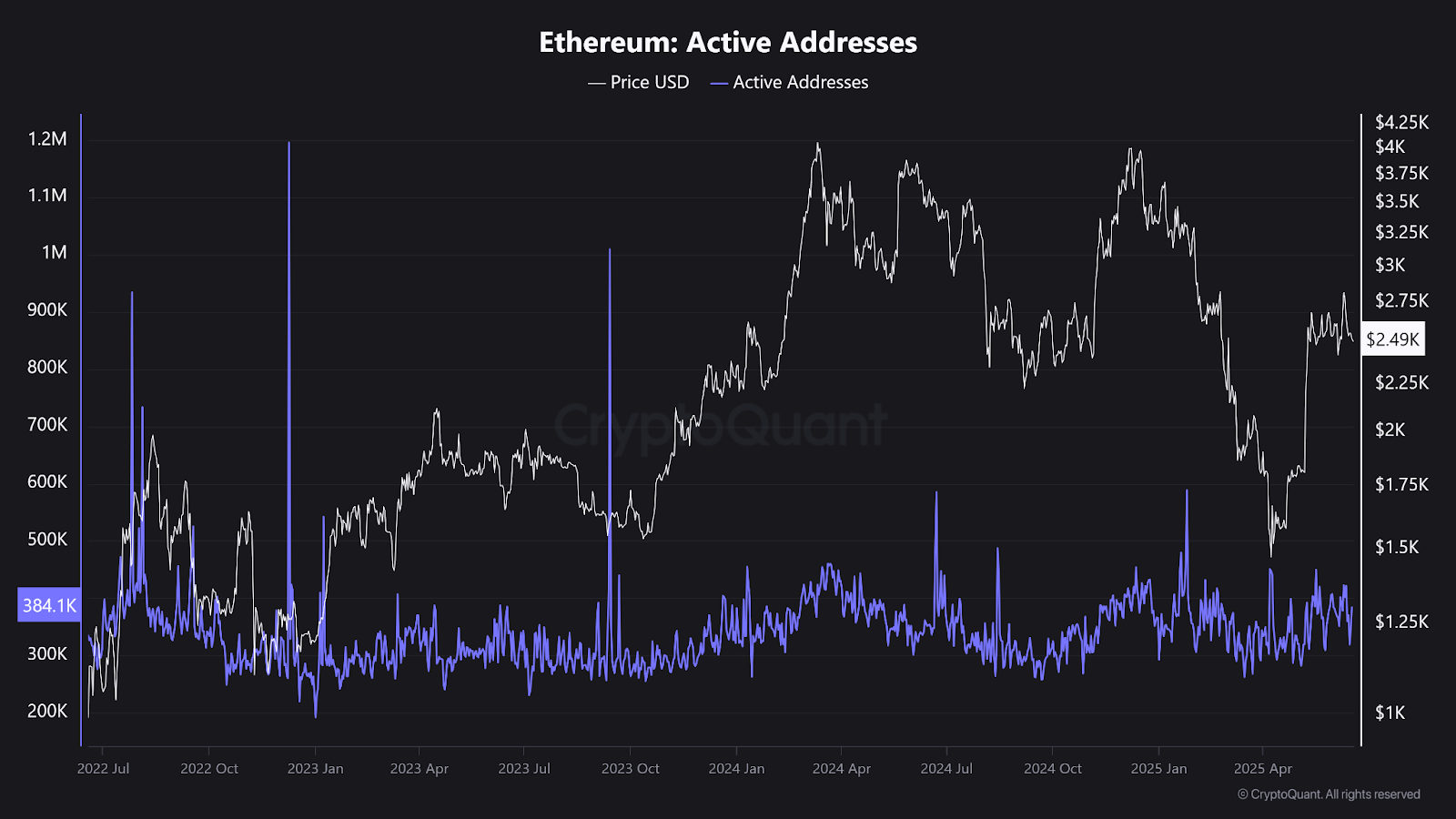

Nonetheless, the lack to interrupt the 50-week EMA might set off a pullback to the help on the $2,000-$2,050 marks, which additionally correlates with the 0.786 Fibonacci retracement stage and previous help. The on-chain knowledge signifies that the lively addresses are at average numbers of about 384,000, which may require an uptick so as to keep an upward pattern of information.