Hyperliquid is rising as a number one crypto derivatives buying and selling platform, notably attracting consideration from giant traders, typically referred to as whales.

Excessive leverage help, quick transaction speeds, low charges, sturdy safety, and a dominant market share make Hyperliquid interesting to whales.

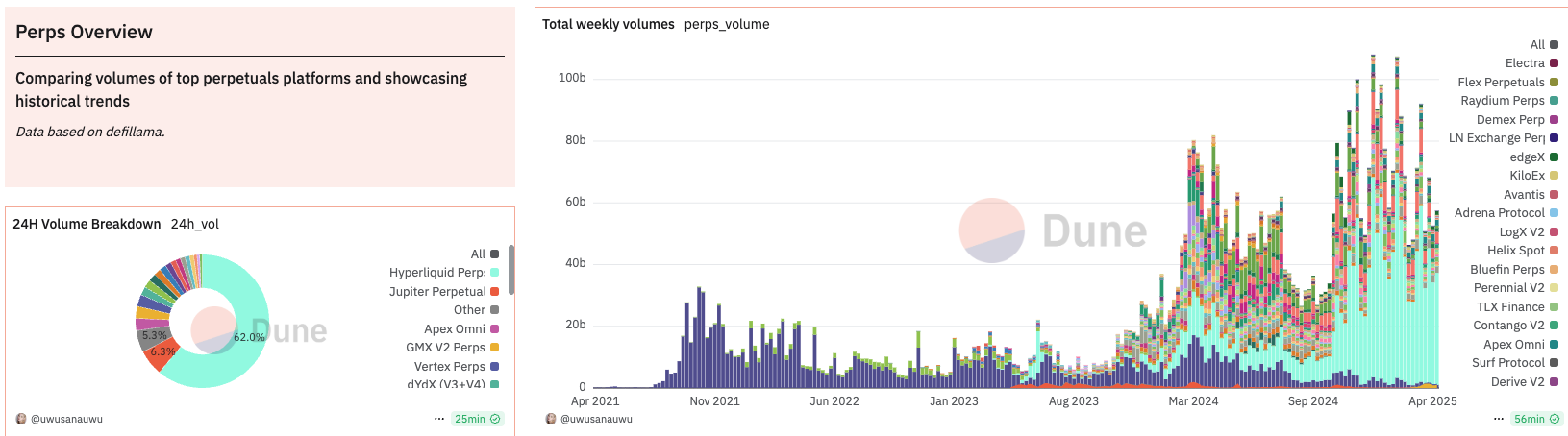

Hyperliquid Instructions Over 60% of the Perps Market Share

Hyperliquid has turn out to be a standout title amongst perpetual futures platforms in current occasions. In line with knowledge from Dune, over the previous 24 hours, Hyperliquid’s perps buying and selling quantity accounted for 62%, totaling over $10.8 billion. Its weekly buying and selling quantity additionally ranks high, exceeding $36.3 billion.

Hyperliquid Perps Buying and selling Quantity. Supply: Dune

With such spectacular efficiency, Hyperliquid perps at the moment maintain over 60% of the market share amongst perpetual futures platforms. Notably, Hyperliquid’s open curiosity reached a report excessive of over $4.9 billion just lately. This determine displays excessive liquidity and demonstrates vital confidence from the buying and selling group, notably whales, in Hyperliquid.

“After the preliminary leverage product challenges on futures buying and selling, seems Hyperliquid has stabilized fairly nicely, constructing to be the #1 futures DEX” commented an X consumer.

Thrilling Whale Actions

Whale buying and selling exercise on Hyperliquid has been bustling, with quite a few large-scale transactions. In line with OnchainLens, crypto professional James Wynn at the moment holds a number of lengthy positions on Hyperliquid, with a complete floating revenue exceeding $39 million.

These positions embrace PEPE (10x leverage), TRUMP (10x), BTC (40x), and FARTCOIN (5x). He has revamped $46 million in simply two months on Hyperliquid from high-leverage positions on Bitcoin and meme cash like PEPE.

Individually, a whale just lately deposited $10 million USDC into Hyperliquid, opening brief positions on BTC, SOL, and ETH with 5x leverage. One other whale injected $8.58 million USDC into Hyperliquid and traded ETH with 2x leverage.

Beforehand, ZachXBT recognized a whale utilizing 50x leverage on Hyperliquid as British cyber prison William Parker. Moreover, a whale dealer opened a 40x leveraged brief place on BTC price $423 million on Hyperliquid, sparking market-wide consideration and triggering a wave of liquidations.

These transactions spotlight whales’ desire for Hyperliquid and mirror the excessive degree of threat they’re keen to tackle the platform. Nevertheless, some suspiciously high-leverage trades on Hyperliquid have raised issues about potential cash laundering. So, what makes Hyperliquid so enticing to whales?

Why Hyperliquid Is the Prime Selection?

Whales favor Hyperliquid because of the platform’s vary of superior benefits. One of many major causes is its capacity to supply excessive leverage and buying and selling flexibility. Hyperliquid permits customers to commerce with leverage starting from 3x to 40x and even as much as 50x.

This notably appeals to giant traders who typically search high-profit alternatives regardless of the numerous dangers.

Moreover, the platform makes use of the HyperBFT blockchain, a proprietary consensus mechanism that processes transactions in underneath a second. This fast pace ensures that whales can execute giant trades with out delays. Hyperliquid additionally stands out with its low transaction charges. Moreover, its dominant market share performs an important function in attracting whales. Excessive liquidity helps scale back transaction prices and slippage dangers, a key concern for whales when buying and selling giant volumes.

Whereas Hyperliquid presents quite a few benefits for whales, it additionally has vital dangers. Excessive-leverage trades typically result in substantial losses. The JELLY delisting is a typical instance. HyperLiquid confronted $230 million in liabilities after a brief squeeze triggered by JELLY whales manipulating its worth.

HyperLiquid responded to the JELLY squeeze by refunding affected merchants and implementing stricter safety measures to forestall future incidents.

Furthermore, regulatory pressures are one other issue to think about. Gracy Chen, CEO of Bitget, shared details about the platform’s KYC/AML concern.

“Regardless of presenting itself as an revolutionary decentralized trade with a daring imaginative and prescient, Hyperliquid operates extra like an offshore CEX with no KYC/AML, enabling illicit flows and unhealthy actors.” stated Gracy Chen

Nevertheless, with its main place and steady technological developments, Hyperliquid stays a best choice for whales, particularly because the crypto derivatives market grows.