Within the high-stakes world of cryptocurrency launches, “snipers” use automated bots to purchase new tokens inside milliseconds of their debut, aiming to safe large income earlier than most buyers even know a token exists.

Inside a Crypto Sniper’s Playbook

Within the frenetic enviornment of cryptocurrency, a brand new kind of participant operates at speeds imperceptible to the human eye: the crypto sniper. In some methods, these aren’t people however automated bots designed to buy newly launched tokens inside milliseconds of their launch on decentralized alternate (DEX) platforms. You’ll be able to nonetheless notice, nonetheless, that an entity or particular person is the pressure behind these bots.

Their purpose is straightforward: purchase on the lowest doable value and promote throughout the subsequent hype-driven value surge. These sniper bots perform by monitoring blockchain exercise in real-time. They scan for the creation of recent liquidity swimming pools or sensible contract occasions that sign a token’s launch. As soon as triggered, they execute purchase orders with high-priority transaction charges, usually outpacing retail merchants by a whole bunch of milliseconds.

On blockchains like Ethereum, this will contain paying exorbitant fuel charges to front-run opponents. On Solana, the place transactions are sooner and cheaper, snipers leverage high-speed RPC nodes to realize an edge. The follow is particularly prevalent in meme coin launches, the place excessive volatility can flip small investments into life-changing sums. In keeping with blockchain evaluation companies and researchers, the identical subtle snipers usually seem behind the most important and most worthwhile launches.

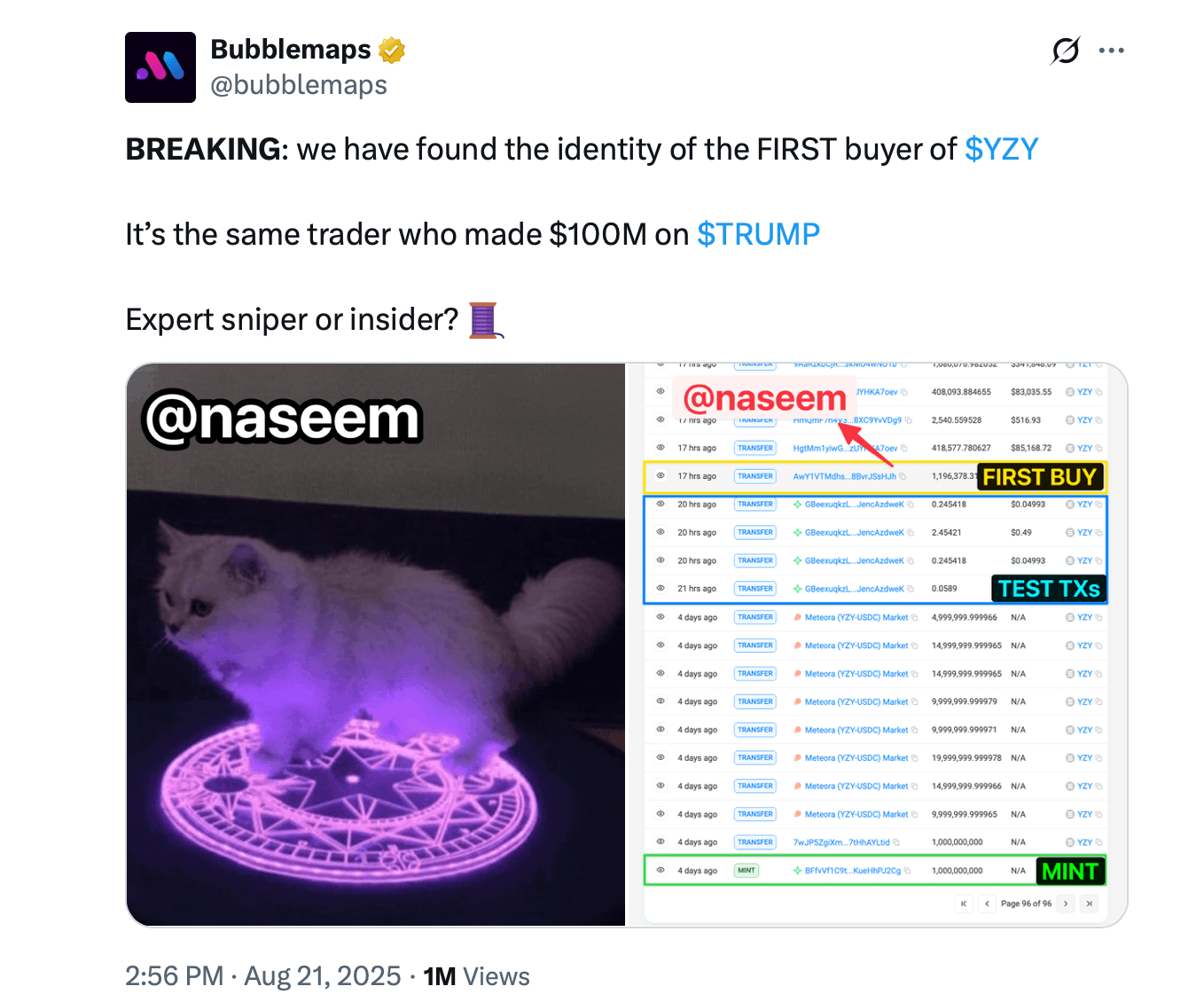

Some suspect these snipers could be insiders, but they nonetheless function with flawless timing, sharp effectivity, and lightning-fast velocity. A current instance entails the launch of YZY, a meme coin related to musician Kanye West, also referred to as Ye. Bubblemaps recognized the primary purchaser as a dealer often called “Naseem,” who invested $250,000 simply because the token went reside. Inside minutes, Naseem executed gross sales totaling $535,000 and withdrew over $1 million in income by means of liquidity removals—all whereas nonetheless holding a considerable place.

Naseem is not any stranger to high-profile snipes. Earlier this yr, he reportedly turned $1.1 million into over $100 million by buying and selling TRUMP, a meme coin linked to U.S. President Donald Trump. His capacity to constantly be the primary purchaser on main meme coin launches like TRUMP, HAWK, and LIBRA has raised questions throughout the crypto neighborhood. “Is it pure ability, or does he know one thing extra?” Bubblemaps requested in a public thread.

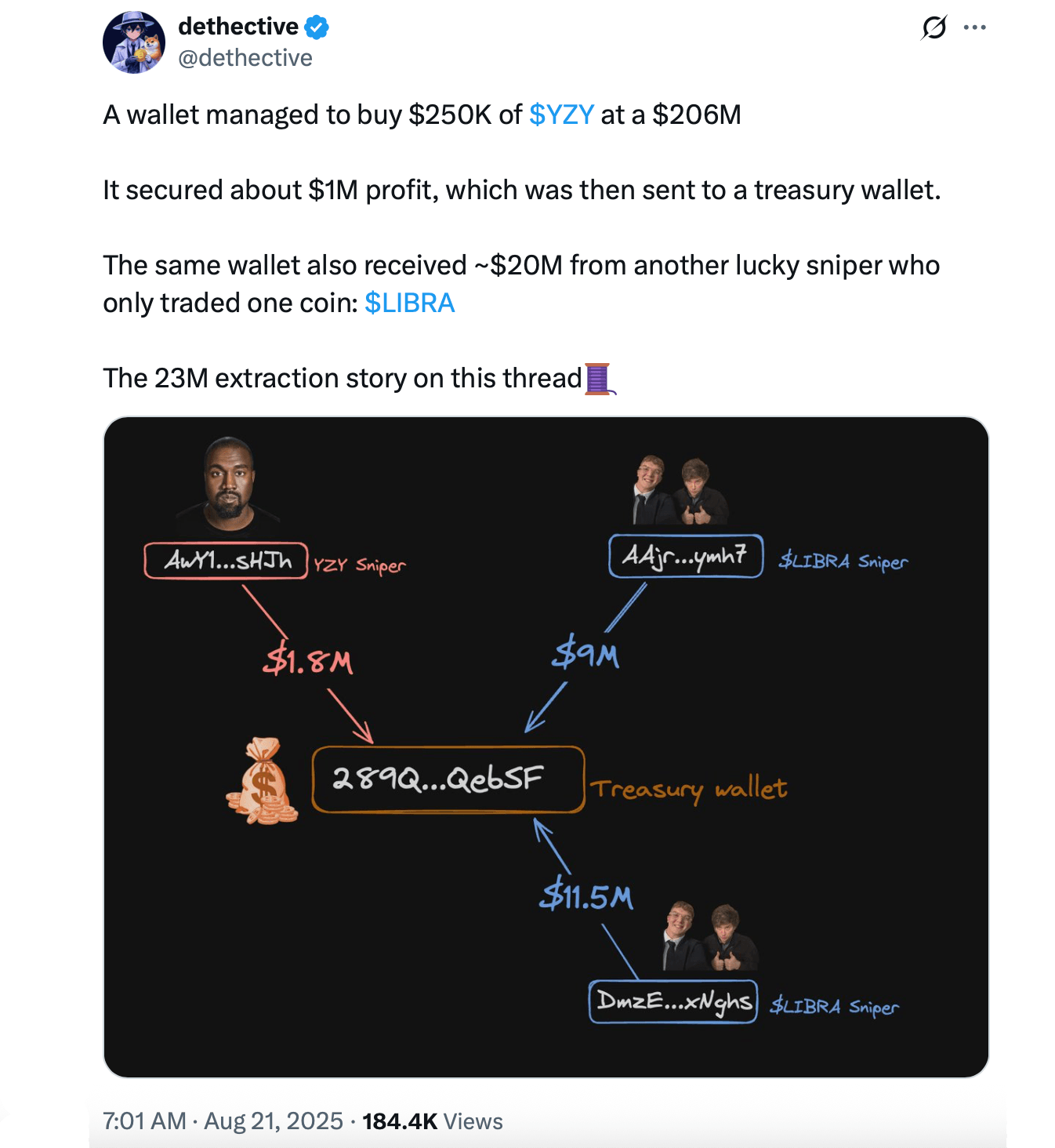

The agency discovered robust onchain hyperlinks between the pockets that purchased YZY and former wallets tied to Naseem, together with these used to snipe each LIBRA and TRUMP. One other evaluation by the analyst dubbed Dethective revealed that the identical treasury pockets that obtained income from the YZY snipe additionally obtained roughly $20 million from a dealer who solely sniped LIBRA.

That dealer, Dethective reported, extracted $11.5 million from the LIBRA launch alone, seemingly utilizing insider info. These incidents spotlight a rising concern: sniping is not only about velocity but additionally potential insider collaboration. When builders or insiders use sniper bots to purchase their very own tokens at launch, it mirrors conventional market manipulation like front-running or insider buying and selling.

Common platforms embrace Banana Gun and Maestro, which provide user-friendly interfaces, usually built-in with Telegram. Some bots are open-source, whereas others require month-to-month subscriptions. For mission groups, combating snipers has turn out to be a precedence. Although some groups are suspected of allowing it, whether or not they deny it or not. Different groups implement anti-snipe mechanisms akin to delayed buying and selling, liquidity pool locks, or honest launch protocols.

Blockchain analytics companies have been creating instruments to detect sniper exercise based mostly on pockets habits. Because the trade matures, the stress between automated benefit and honest entry will seemingly form technological responses going ahead. For now, the snipers maintain taking pictures—and cashing in.