Ethereum continues to consolidate just under a key resistance zone following a powerful rally from earlier this month. Whereas worth stays technically bullish, ETH has but to substantiate a breakout above this vital degree.

Technical Evaluation

The Every day Chart

On the day by day chart, ETH is buying and selling just under the confluence of the 200-day and the $2,800 provide degree. But, the 100-day transferring common is at the moment under the asset, offering help just under the $2,100 demand zone. With the value being trapped between these two transferring averages, a breakout to both facet might be the start of a brand new impulsive transfer.

In the meantime, the RSI sits round 66, just under overbought situations however on a downtrend, reflecting slowing upside power, with a bearish divergence forming, which signifies {that a} correction is possible within the coming weeks.

The 4-Hour Chart

Dropping decrease on the 4-hour timeframe, Ethereum is displaying indicators of weakening momentum. After the explosive transfer above $2,100, the value has been consolidating inside a slender ascending channel close to the $2,500–$2,600 vary. But, the RSI has been on a slight uptrend, indicating that the momentum is slowly shifting in favor of the consumers on this timeframe.

But, for any significant rally to start, the market wants to interrupt out of the channel with pressure and quantity. In any other case, a drop under the $2,600 degree, which is now appearing as a short-term help, would seemingly result in a breakdown of the channel and a worth decline again towards the $2,100 demand zone.

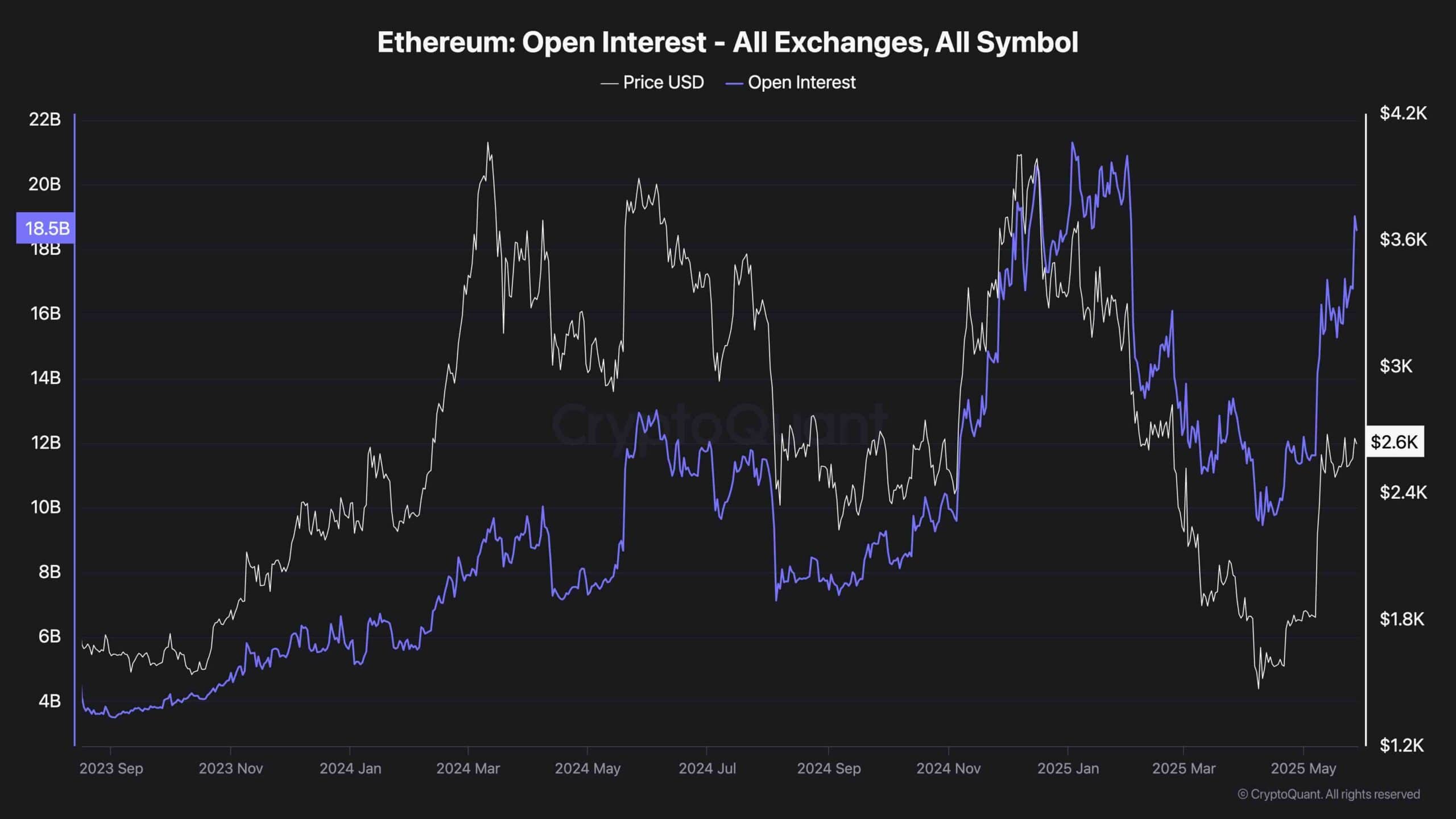

Ethereum’s open curiosity has surged sharply, now standing at $18.5B, approaching its earlier all-time highs seen originally of the 12 months. This vital uptick in open curiosity alongside rising costs suggests a buildup of leveraged lengthy positions throughout the market.

Whereas this usually signifies sturdy bullish sentiment and dealer confidence, it additionally introduces potential danger. When open curiosity climbs aggressively with no clear breakout, it may sign overcrowding and enhance the probabilities of a liquidation-driven pullback. The present positioning displays excessive anticipation of a breakout above $2.8K.

Nonetheless, if ETH fails to clear that resistance, the market might see a swift correction as overleveraged longs are flushed out.