Ethereum has seen a pointy rejection from its native highs, slipping again right into a crucial assist zone. With netflows displaying persistent outflows and momentum cooling, the market is now testing whether or not bulls can defend key ranges or if deeper retracements are forward.

Technical Evaluation

By Shayan

The Each day Chart

On the every day chart, ETH failed to carry above $4,400, breaking beneath the small ascending channel shaped not too long ago. This breakdown has shifted momentum, with value now hovering round $4,200. The RSI can also be sitting round 40, reflecting a lack of bullish energy however not but an excessive oversold situation.

The primary main assist is discovered close to $4,000, adopted by the $3,800 space, which traces up with the 100-day shifting common and the decrease boundary of the bigger channel. If patrons defend this degree, ETH may kind the next low construction, preserving the broader uptrend intact.

For now, ETH’s mid-term development stays bullish so long as $3,700 holds, however the momentum shift suggests extra draw back probing earlier than energy returns.

The 4-Hour Chart

The 4H chart paints a clearer image of current weak spot. ETH broke down from its $4,400–$4,800 consolidation vary and shortly dropped towards $4,100. Momentum is now closely tilted to the draw back, with RSI close to 30, displaying short-term oversold situations. Whereas this might spark a reduction bounce, the breakdown has shifted the native development bearish till $4,400 is reclaimed.

The subsequent sturdy liquidity cluster sits round $3,800, which aligns with each horizontal demand and the ascending trendline. This zone is probably going the place patrons will try to step in aggressively. If ETH can maintain and rebound from this space, the primary upside goal could be $4,200, adopted by a retest of the important thing $4,400 degree. Then again, failing to carry above $3,800 may speed up promoting strain, dragging the market into an total bearish section.

Onchain Evaluation

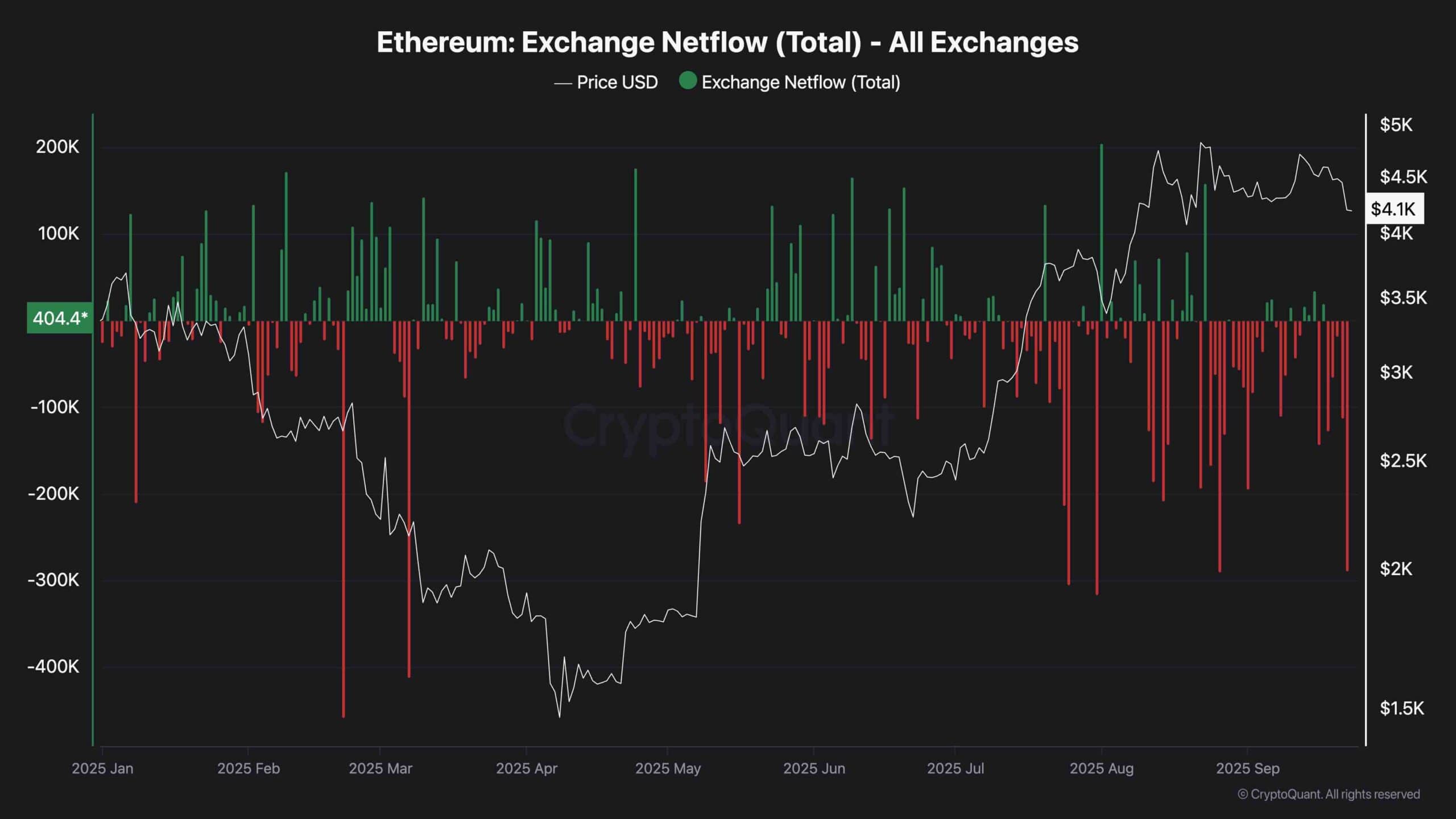

Change Netflows

Change netflows proceed to indicate massive adverse spikes, indicating constant ETH outflows from exchanges. This implies buyers are shifting cash into self-custody or staking, which reduces sell-side provide and is mostly bullish over the medium to long run.

Nonetheless, within the brief time period, the market is extra influenced by technical weak spot and profit-taking at current highs. If accumulation continues throughout this dip, it may set the stage for a powerful restoration later, however for now, market sentiment leans towards testing decrease assist ranges earlier than a brand new bullish leg begins.