Ethereum has amassed $425 million in capital from SharpLink Gaming’s treasury allocation. The most important altcoin has attracted giant volumes of institutional capital inflows to ETFs previously week. Whales and establishments have tried to reinstate confidence amongst merchants, nonetheless the method has confirmed painfully sluggish.

We dive deeper and discover out why merchants should not shopping for Ethereum’s (ETH) new narrative and what it would take for ETH to interrupt out of the consolidation and hit a brand new all-time excessive this cycle.

Desk of Contents

Ethereum ETF flows and whale accumulation

Ethereum Spot ETFs have attracted persistently giant inflows from institutional traders within the final 4 weeks. Information from crypto intelligence tracker SoSoValue reveals that the day by day whole netflow to Ethereum ETFs exceeds $11 million.

Ethereum ETFs recorded a big spike on June 11 with a day by day web influx that exceeds $240 million. This week the inflows have been comparatively beneath common, anticipated to select up within the latter half, amidst latest bullish developments.

Ethereum web inflows | Supply: SoSoValue

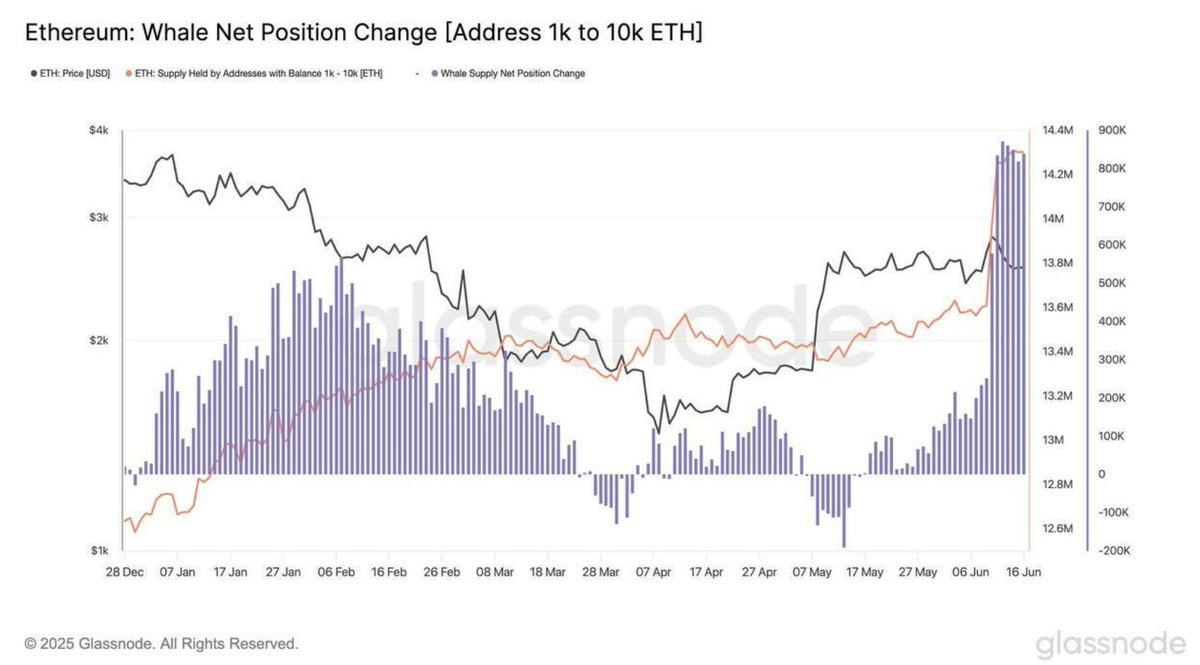

Information from crypto intelligence tracker Glassnode reveals that the day by day whale accumulation has exceeded 800,000 Ether. The Ethereum holdings of whales that personal 1,000 to 10,000 Ether have exceeded 14.3 million Ether, as of June 16. June 12 alone recorded the best day by day web influx, the place giant pockets traders added over 871,000 Ether.

Ethereum whale web place change for addresses holding between 1K and 10K ETH | Supply: Glassnode

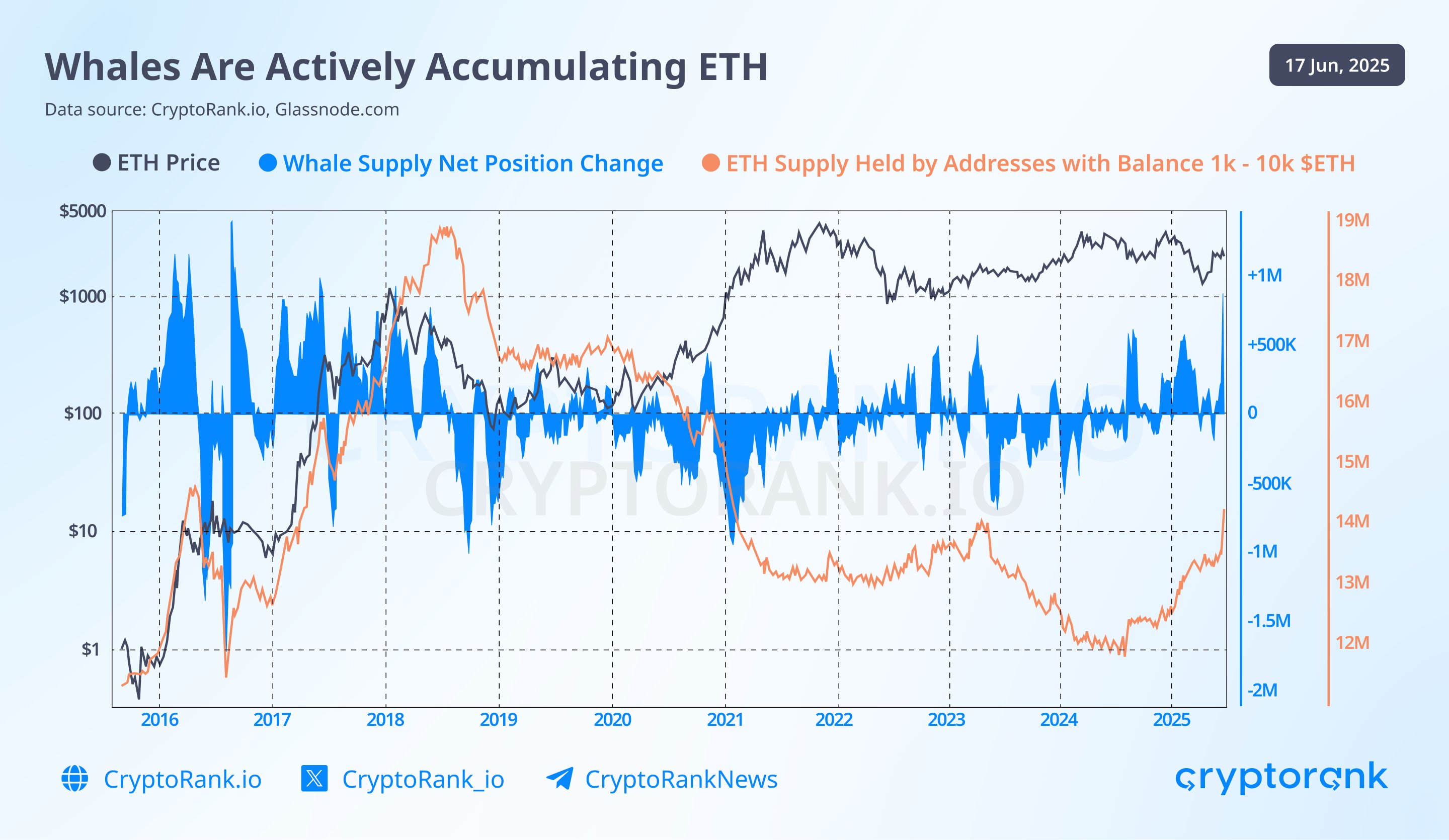

Crypto analysts at Cryptorank noticed that the size of whale accumulation seen on this cycle is uncommon and has not been seen for the reason that starting of the bull run in 2017. Beginning H2 2024, whales have been accumulating ETH, with the pattern rising sharply within the final 4 weeks, supporting a bullish thesis for Ether.

Whale accumulation of Ethereum | Supply: Cryptorank

You may also like: Ethereum worth outlook: $3,200 or $1,587 as 39-day vary nears breakout

In Ethereum they trust- Trump Media’s twin Bitcoin and Ethereum ETF submitting

Trump Media and Expertise Group (DJT), an American expertise large headquartered in Florida boasts US President Donald Trump as a majority proprietor. The corporate filed for a twin Bitcoin and Ethereum ETF on June 16, with a 75% allocation to BTC and 25% to ETH.

In its SEC submitting, Trump Media listed Crypto.com as its custodian and liquidity supplier, pending regulatory approval. If the US monetary regulator approves the product, it will be the primary dual-spot crypto ETF backed by the President of america.

Specialists consider Ethereum’s inclusion within the twin ETF shouldn’t be a mere coincidence, fairly a present of confidence amidst the rising institutional curiosity in Ether. World Liberty Monetary, one other entity backed by the Trump household, has slowly diminished its publicity to Ether since its launch, elevating issues whether or not the Ethereum allocation is a gesture at greatest; there is no such thing as a information on the non-public crypto holdings of Trump members of the family.

Why merchants aren’t shopping for the brand new Ethereum narrative

The Trumps confirmed their help for Ethereum, ETH obtained a $425 million capital allocation, however market contributors stay largely unmoved. It virtually looks as if merchants aren’t shopping for the brand new Ethereum narrative.

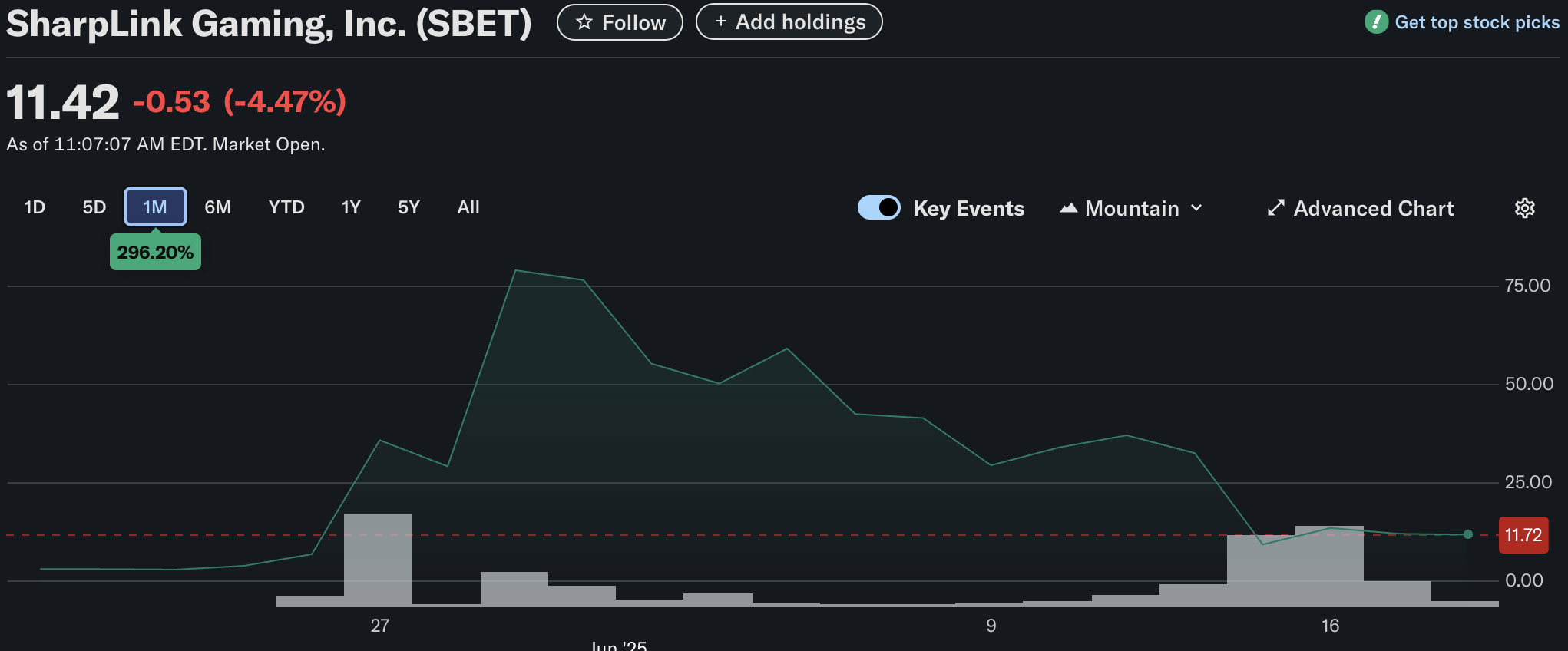

SharpLink purchased 176,000 Ether for $425 million, and allotted the altcoin to their treasury. Whereas the agency grew to become the biggest company holder of Ether, it ushered in a steep decline in its inventory worth.

SharpLink Gaming inventory efficiency | Supply: Yahoo Finance

SharpLink Gaming’s submitting probably confused shareholders and led to the correction. Irrespective, there’s a insecurity amongst market contributors, and neither Ethereum’s worth nor SBET has recovered for the reason that announcement.

Joe Lubin and executives from Consensys have tried to publicly reassure stockholders and ETH merchants; nonetheless, the inventory is down 4.47% for the reason that market opened on Wednesday.

At a time when the Ethereum Basis has labored on its narrative, modified the management, organizational targets and Vitalik Buterin shifted focus to technical growth. Thus far, there is no such thing as a vital influence on ETH worth, and the altcoin is consolidating near key help at $2,400.

Ethereum believers have added the SharpLink treasury’s buy as a key catalyst for Ether, alongside institutional curiosity in Ether, the modified roadmap and upcoming technical upgrades.

Proof is within the on-chain information. With no vital spike in lively addresses, staking progress or the token’s worth, Ether struggles on the time of writing.

You may also like: Why are Bitcoin and crypto costs down as we speak?

Ethereum worth forecast

Ethereum is buying and selling at $2,501, above key help on the $2,373 degree on Wednesday. ETH is lower than 10% away from the higher boundary of the FVG on the day by day timeframe, at $2,743. A day by day candlestick shut above this degree might push Ether in the direction of $3,000, a psychologically necessary degree for the altcoin.

Two key momentum indicators, RSI and MACD recommend additional consolidation is probably going within the short-term. RSI reads 47, slightly below the typical, and MACD flashes crimson histogram bars below the impartial line, which means there may be an underlying damaging momentum within the Ether worth pattern within the ETH/USDT day by day worth chart.

ETH/USDT day by day worth chart | Supply: Crypto.information

Knowledgeable commentary

Sui Chung, CEO of CF Benchmarks informed Crypto.information in a written notice,

“Ethereum seems to be having its AWS second — quietly however decisively establishing itself because the foundational settlement layer for on-chain monetary infrastructure. We’re witnessing this transformation unfold in actual time, and up to date regulatory and market developments are accelerating the shift.

The SEC’s latest pivot on DeFi regulation is the newest in a string of optimistic developments that may act as an entry sign for establishments which have hitherto remained on the sidelines. However this isn’t nearly worth.

The broader context issues. The SEC’s softer stance, the success of Circle’s IPO, and stablecoin adoption by main e-commerce platforms are coalescing into an ideal storm. Ethereum is not only a “crypto” story — it’s turning into indispensable infrastructure. t’s not about “blockchain” anymore — not within the summary. It’s about industrial-grade, programmable cash techniques. And Ethereum is main the cost.”

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.