Bitcoin has been buying and selling close to its all-time excessive (ATH), holding above $100,000 for the previous two months. Nevertheless, spot buying and selling quantity has not adopted go well with. Not like earlier bull runs, this value stage has not triggered a surge in buying and selling exercise.

This divergence has raised issues amongst buyers. Current analyses from CryptoQuant, Glassnode, and different market knowledge sources present key insights into this uncommon pattern.

Bitcoin Worth Decouples from Spot Quantity — What Does It Imply?

In accordance with Dan from CryptoQuant, the market is at present in a “cooling” section with out indicators of overheating.

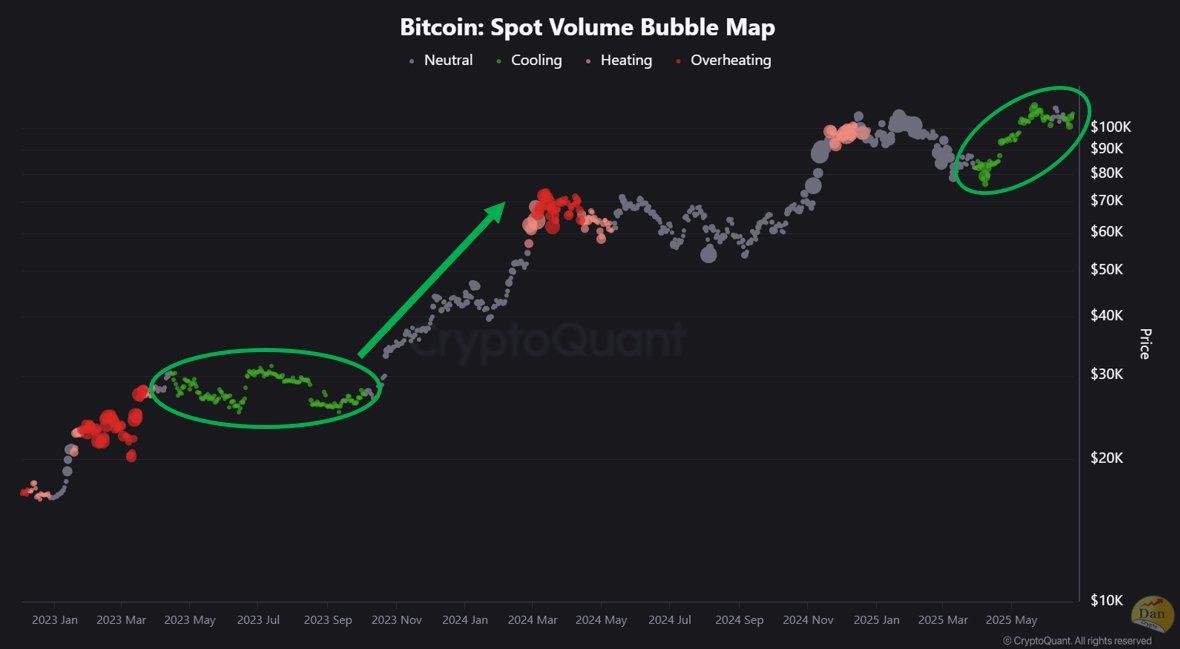

Bitcoin Spot Quantity Bubble Map. Supply: CryptoQuant.

The chart illustrates that the scale of every circle represents buying and selling quantity, whereas colour signifies the expansion price of that quantity. A drop in quantity indicators a cooling market. A impartial market exhibits no sharp adjustments, and speedy will increase in quantity could point out overheating.

At current, inexperienced circles — which signify cooling — dominate the chart, at the same time as Bitcoin nears its ATH. This implies the absence of speculative frenzy. Dan emphasised that this section requires persistence.

“At the moment, Bitcoin is close to its all-time excessive, however the market exhibits a cooling pattern with out indicators of overheating. To interrupt previous its all-time excessive, macroeconomic catalysts like rate of interest cuts or regulatory easing could also be wanted. Nevertheless, the market has already established a steady basis. Thus, a method of persistence, maintaining a tally of main market occasions, and ready for alternatives appears promising,” Dan famous.

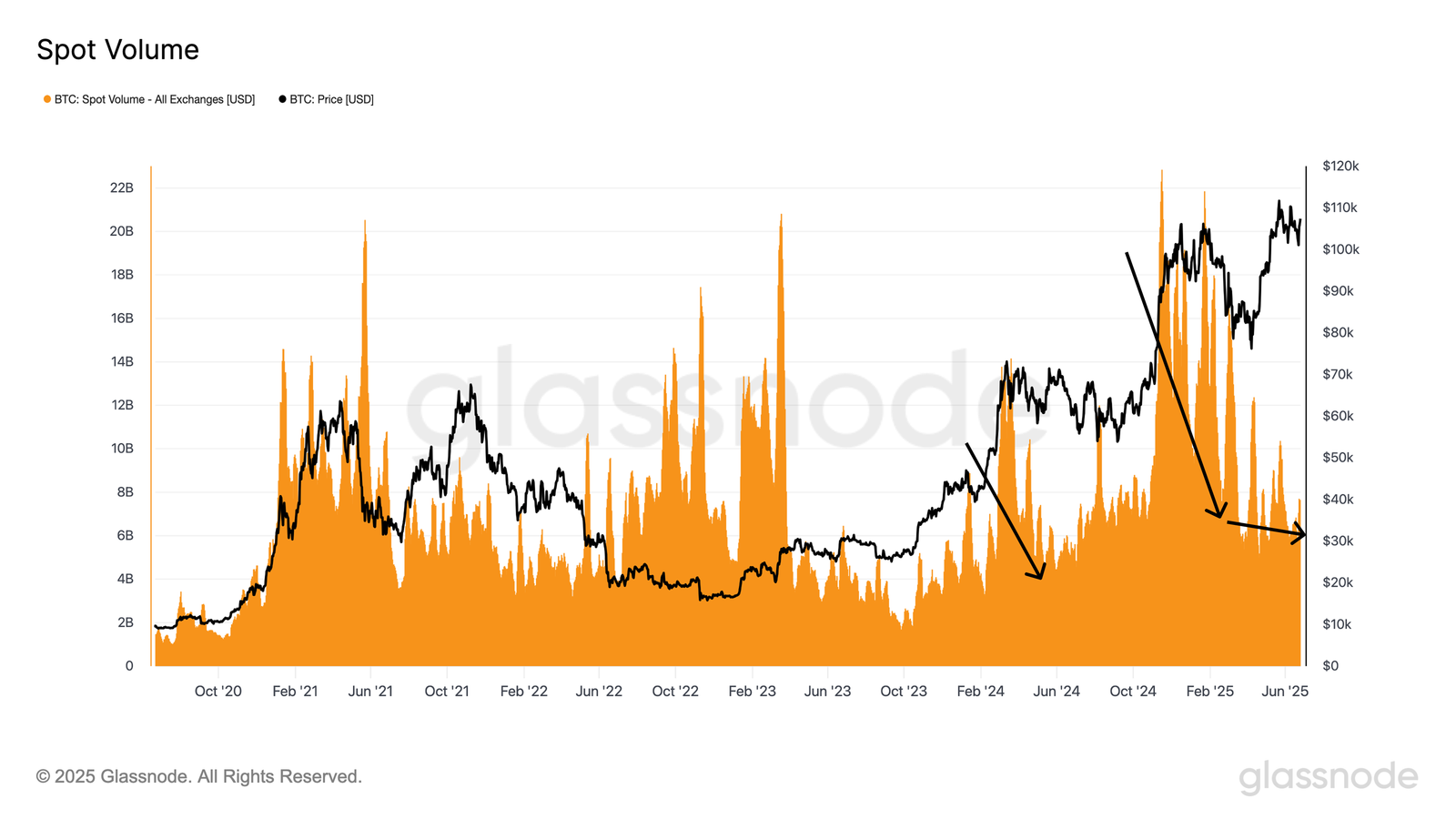

Moreover, Glassnode’s Week 25 report echoes CryptoQuant’s evaluation. It identified that, not like the ATH rallies in Q2 and This fall of 2024, the current climb to over $100,000 has not been accompanied by a corresponding rise in spot quantity.

This displays an absence of speculative depth — a key attribute usually seen in earlier bull runs.

Bitcoin Spot Quantity on All Exchanges. Supply: Glassnode.

As a substitute, Glassnode means that accumulation methods possible drive the present value rise. Lengthy-term buyers seem like holding their Bitcoin quite than promoting for revenue.

“Present spot quantity sits at $7.7 billion, considerably decrease than the cyclical peaks noticed earlier on this bull market. This divergence additional underscores the dearth of speculative depth, highlighting the market’s hesitancy and reinforcing the consolidation narrative,” the report said.

Shrinking Liquid Provide Provides to the Puzzle

One other essential issue is the declining liquid provide of Bitcoin.

In accordance with knowledge from Glassnode and different sources, solely about 25% of the full Bitcoin provide stays liquid. The remaining 75% is held by illiquid entities — usually long-term holders or establishments with no intent to promote.

Bitcoin Illiquid Provide. Supply: Glassnode.

“Bitcoin illiquid provide retains climbing & is at all-time-highs. Solely 25% of Bitcoin’s provide stays ‘liquid.’ The provision shock will probably be brutal!” Nic, co-founder of Coin Bureau, stated.

This creates a possible provide disaster. With fewer cash out there available on the market, even average demand can drive costs increased. This helps clarify why Bitcoin stays close to ATH ranges and not using a spike in spot buying and selling quantity.

The drop in spot quantity could sign an absence of retail investor FOMO, which fueled earlier bull cycles. As a substitute, it may point out a shift towards long-term worth investing over short-term hypothesis.

Nonetheless, with out macroeconomic catalysts like rate of interest cuts or technical breakthroughs to spice up market confidence, Bitcoin’s value may stagnate.