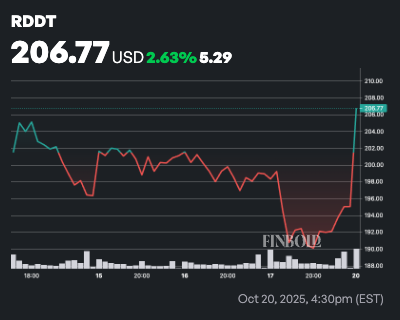

Reddit (NYSE: RDDT) is surging increased, climbing 6% to $206 as of early buying and selling on October 20.

Certainly, this surge comes at a time when RDDT inventory has confronted volatility, dropping 20% over the previous month. Yr-to-date, nevertheless, the social media big stays up 24%.

The rally comes after funding agency Raymond James raised its Reddit inventory value goal to $250 from $225, whereas sustaining a ‘Sturdy Purchase’ ranking.

Notably, Raymond James analyst Josh Beck, highlighted a stronger outlook for Reddit’s promoting income pushed by enhancements in monetization metrics and the corporate’s rising potential in AI-powered search.

Beck’s up to date bottom-up Common Income Per Person (ARPU) mannequin outlines a $100 U.S. logged-in ARPU bull case, fueled by average will increase in advert load, a considerable soar in CPMs (value per thousand impressions), and a lift from AI search capabilities which are anticipated to elevate on-platform question volumes.

In accordance with Beck, latest company checks indicated CPMs exceeding $6 for e-commerce campaigns, representing triple-digit development year-over-year.

Even underneath a extra conservative state of affairs, Reddit’s generic marketing campaign CPM estimate has been raised to $4 from $2 in prior evaluation, signaling that advertisers are paying much more to succeed in customers on the platform.

The analyst’s mannequin assumes that Reddit’s dwelling feed advert load might rise from 13% to 17%, which stays under friends like Meta and Snap that function within the 25–50% vary.

Reddit inventory fundamentals

Moreover, the agency tasks Reddit’s AI Search/Reply function might enhance month-to-month queries from 1.5 billion to 4 billion, creating an untapped $350 million income alternative.

The bullish name builds on Reddit’s spectacular fundamentals. The corporate boasts a 91.04% gross revenue margin and has grown its income by 70% year-over-year, reaching $1.67 billion over the previous twelve months.

Raymond James’ improve provides to a refrain of optimistic analyst outlooks. Residents Monetary not too long ago maintained its ‘Market Outperform’ ranking with a $300 value goal, whereas Truist Securities lifted its goal to $260, citing expectations for sturdy third-quarter outcomes and upbeat fourth-quarter steering.