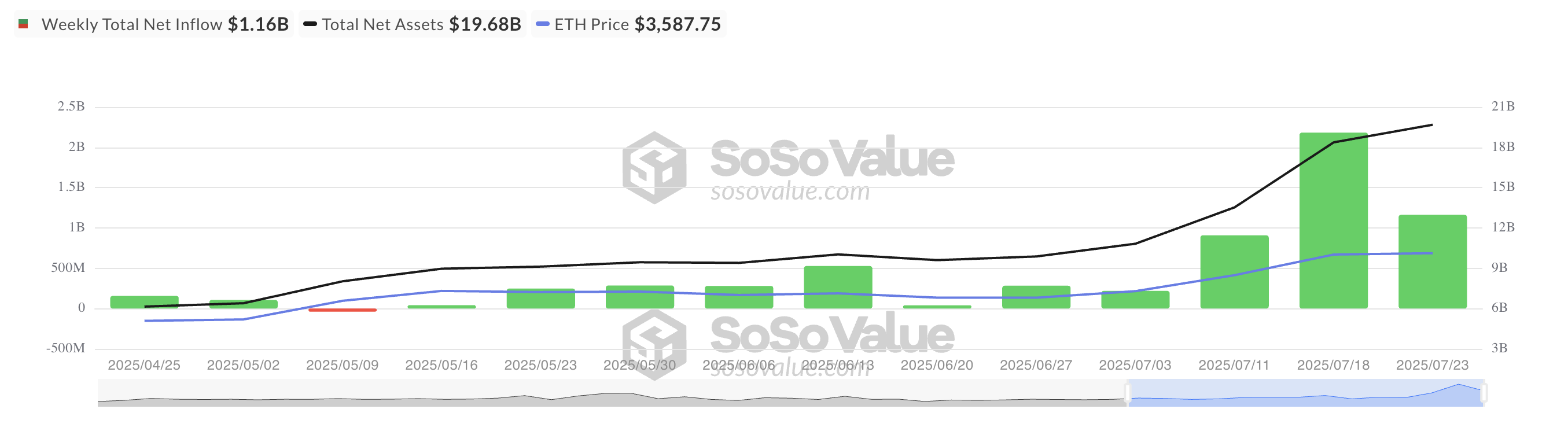

Ethereum (ETH) continues to draw institutional curiosity regardless of a current pullback in value. This week alone, greater than $1 billion has flowed into ETH funding funds, which highlights rising institutional urge for food for the asset.

Nonetheless, the coin’s value efficiency doesn’t mirror this bullish funding exercise. Regardless of the heavy inflows, ETH stays underneath stress, largely as a result of elevated profit-taking by long-term holders (LTHs).

Ethereum Inflows Hit 11-Week Streak as Value Falls Beneath $3,600

In keeping with SosoValue, the second-largest crypto by market cap is presently in its eleventh consecutive week of web inflows into ETH ETFs. That is in sharp distinction to Bitcoin (BTC), which has witnessed notable web outflows not too long ago as its value decline seems to have shaken investor confidence.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Complete Ethereum Spot ETF Internet Influx. Supply: SosoValue

But, regardless of this robust wave of institutional help for ETH, the inflows haven’t translated into upward value momentum. Quite the opposite, ETH’s value continues to fall, weighed down by a surge in profit-taking exercise.

At press time, the altcoin trades at $3,553, down 5% since Monday. What’s triggering this dip?

Sensible Cash Is Quietly Heading for the Exit

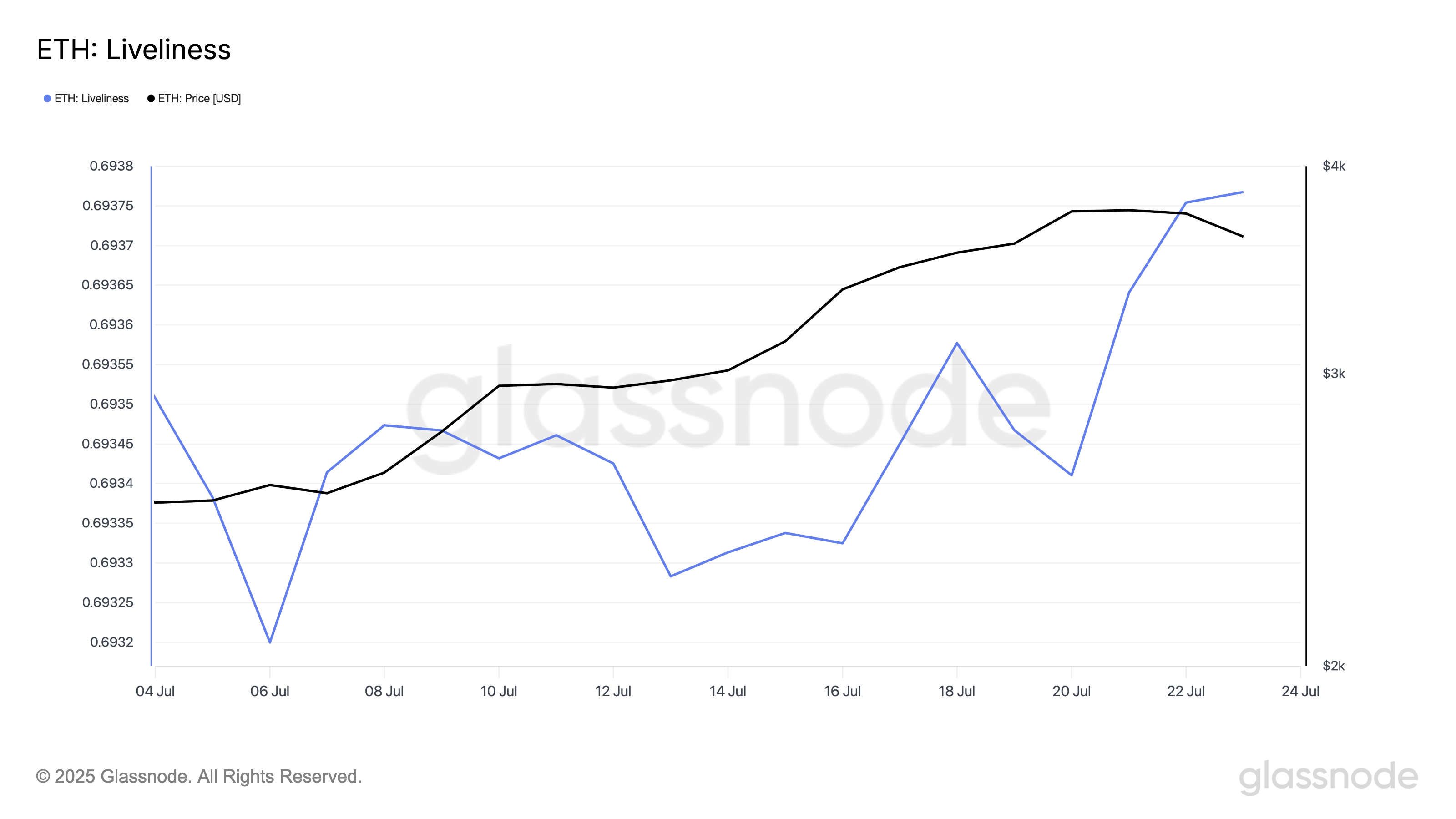

On-chain information reveals an uptick in ETH’s Liveliness, which means that long-term holders (LTHs), usually essentially the most resilient arms available in the market, are more and more promoting their cash. At press time, this stands at 0.69.

ETH Liveliness. Supply: Glassnode

Liveliness measures the motion of long-held tokens by calculating the ratio of coin days destroyed to the entire coin days gathered. When it falls, LTHs are transferring their property off exchanges and opting to carry.

Conversely, when it rises like this, extra dormant tokens are being moved or bought, signaling profit-taking by long-term holders.

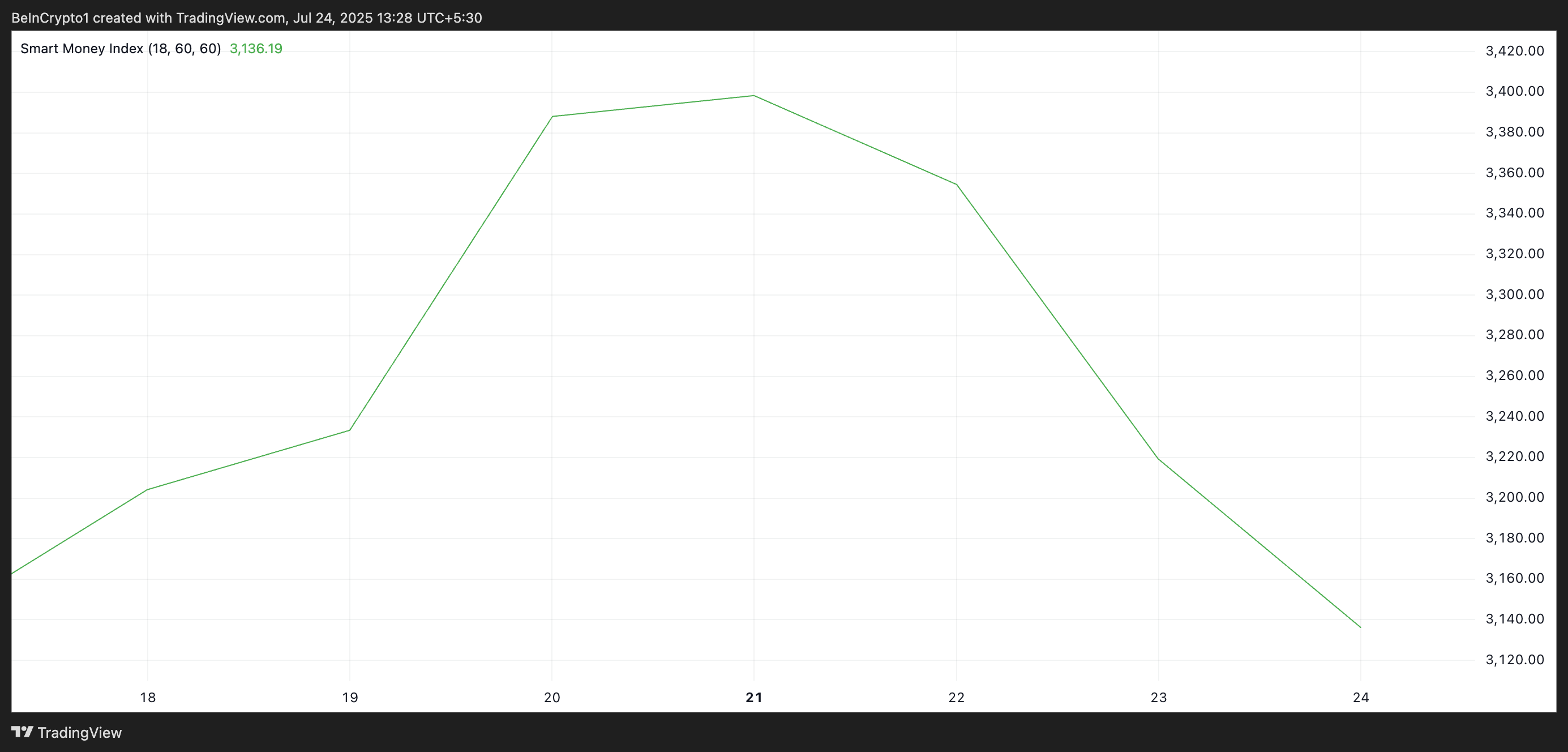

Moreover, on the ETH/USD one-day chart, the decline in ETH’s Sensible Cash Index (SMI) confirms the selloff amongst key coin holders. Readings from this indicator present that its worth has dipped by 7% since July 20.

ETH SMI. Supply: TradingView

Sensible cash refers to capital managed by institutional buyers or skilled merchants who perceive market developments and timing extra deeply. The SMI tracks the habits of those buyers by analyzing intraday value actions.

Particularly, it measures promoting within the morning (when retail merchants dominate) versus shopping for within the afternoon (when establishments are extra lively).

When an asset’s SMI falls like this, good cash is offloading its positions—and in ETH’s case, this distribution seems to be pushed by a want to lock in positive factors from its current rally.

ETH Faces Tug-of-Battle Between Sensible Cash Sellers and Dip Patrons

ETH eyes a decline beneath $3,524 if its key holders proceed to promote. If this degree offers approach, the altcoin might alternate arms round $3,314. A failure by the bulls to supply help at that time might set off a deeper correction towards $3,067.

ETH Value Evaluation. Supply: TradingView

Nonetheless, if buy-side stress will increase, this bearish outlook can be invalidated. In that state of affairs, ETH’s value might revisit its current cycle peak at $3,859 and doubtlessly try a breakout above that degree.