Ethereum is forming a bullish cup-and-handle sample above its 200-day EMA because it trades round $2,509. Will ETH escape above $3,000?

Ethereum continues to consolidate inside a variety, sustaining dominance above its 200-day EMA at $2,457. As ETH’s consolidation persists, a bullish cup-and-handle sample is rising on the each day chart. Will Ethereum escape of the sample for an prolonged rally?

Ethereum Worth Evaluation

On the each day chart, Ethereum shows a rounding-bottom reversal between February and Might, with the neckline aligning with the 61.80% Fibonacci degree at $2,712. Presently, Ethereum is transferring sideways just under this neckline, supported by the 200-day EMA at $2,457.

The sideways motion and U-shaped reversal full the rounding-bottom sample on the each day chart. Moreover, the reversal has resulted in a bullish crossover between the 50-day and 100-day EMA traces, signaling a possible short-term development reversal and growing the probabilities of a breakout.

At current, Ethereum is buying and selling at $2,509, close to the decrease boundary of the sample and the 200-day EMA, whereas the RSI line continues to say no. This means weakening momentum and a hidden bearish divergence, suggesting the potential for a breakdown.

In such a situation, the speedy help lies on the 50% Fibonacci degree at $2,386, adopted by the 38.20% degree at $2,098. Nevertheless, if the broader market recovers, a bullish breakout from the sample is feasible. This might set off an uptrend towards the 78.60% Fibonacci degree at $3,255.

Optimistically, a confirmed breakout might prolong the rally towards the 100% Fibonacci degree at $4,108.

Derivatives Market Stays Hopeful

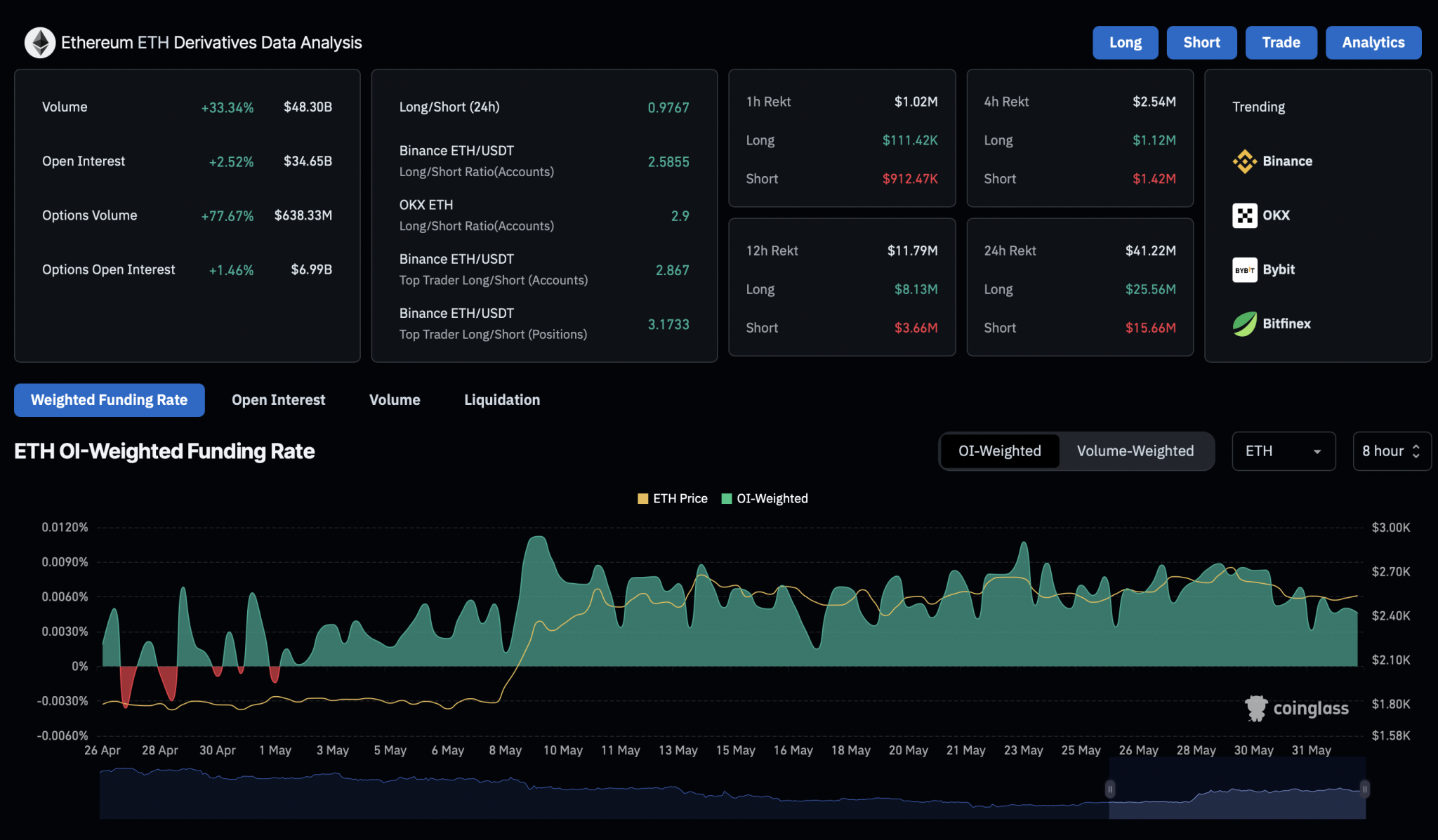

Regardless of the hidden bearish divergence within the RSI hinting at a possible pullback, the bullish chart sample has sparked elevated optimism within the derivatives market. Ethereum open curiosity has risen by 2.52%, reaching $34.65 billion, with a barely elevated funding charge of 0.0046%.

Ethereum Derivatives

This means rising bullish exercise available in the market. Nevertheless, lengthy liquidations have climbed to $25 million over the previous 24 hours, whereas quick liquidations stay decrease at $15.66 million.

Presently, the long-to-short ratio over the previous 24 hours stands at 0.9767, indicating a slight bearish bias available in the market.