World Liberty Monetary (WLFI)’s USD1 stablecoin has surpassed a $2 billion market capitalization.

The milestone comes amid a big growth within the stablecoin sector, with specialists predicting it might surge to $2 trillion within the coming years.

USD1 Stablecoin’s Development: From $128 Million to $2 Billion

WLFI co-founder Zach Witkoff shared the event within the newest X (previously Twitter) submit.

“Proud to announce that @worldlibertyfi USD1 stablecoin has formally crossed $2 billion in market cap. Happy with the crew, onwards!” Witkoff posted.

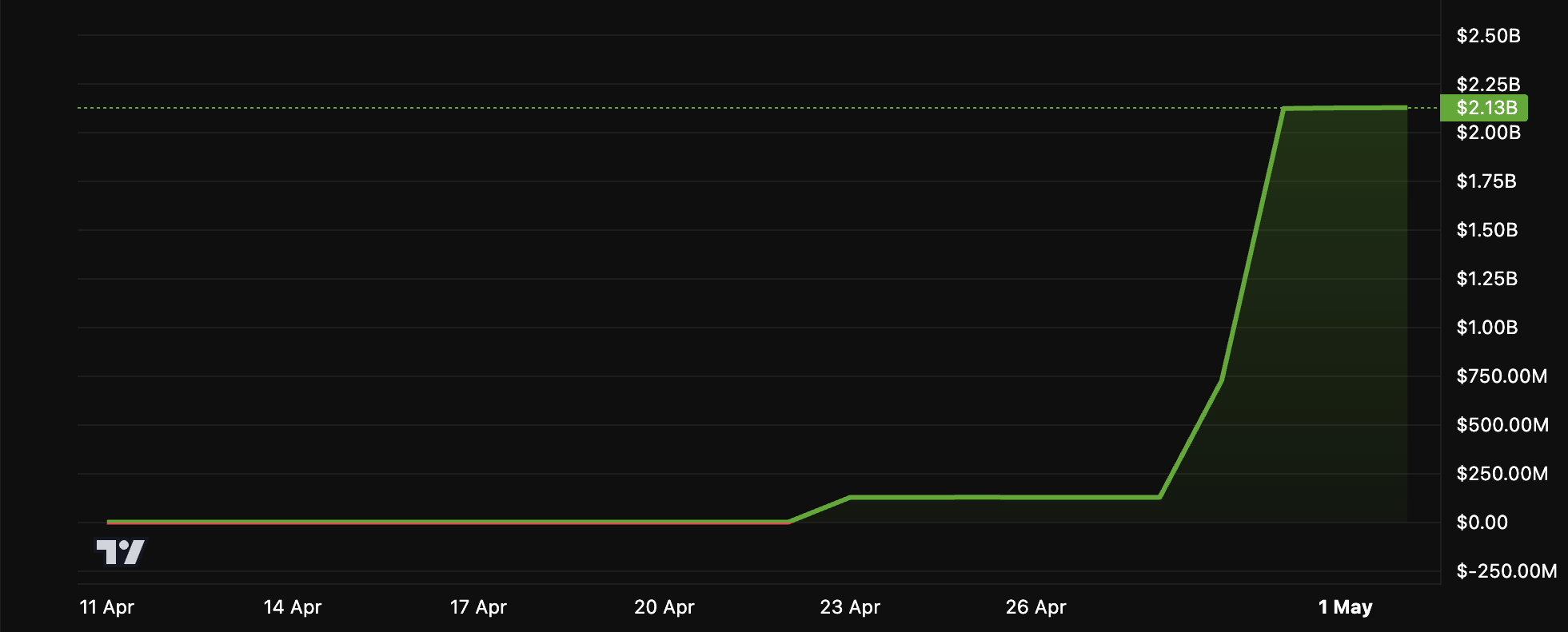

Information from BeInCrypto exhibits that USD1 skilled important progress over a brief interval. On April 28, its market cap was $128 million. Nonetheless, by the following day, it surged to $1 billion.

“Congratulations to the @worldlibertyfi crew on USD1 reaching a $1 billion market cap,” BitGo wrote on X.

That’s not all. By April 30, the market cap doubled to $2.1 billion, rating USD1 57th amongst all cryptocurrencies and seventh amongst stablecoins. It overtook established gamers like PayPal USD (PYUSD) and First Digital USD (FDUSD).

The truth is, the surge has additionally solidified USD1’s standing on the Binance Sensible Chain, the place it now ranks because the second-largest stablecoin.

USD1 Market Capitalization. Supply: BeInCrypto

This highlights the rising adoption and belief in USD1. The ascent positions it as one of many fastest-growing decentralized stablecoins available in the market since its launch in late March.

Information from Dune’s blockchain analytics platform supplies additional perception into the elements driving this growth. A collection of minting occasions within the final week of April catalyzed the stablecoin’s market cap enhance to over $2 billion.

These minting actions align with WLFI’s strategic efforts to develop the token’s circulation. Earlier this month, the DeFi mission proposed a USD1 airdrop to early supporters. As BeInCrypto reported, the airdrop is meant to check the on-chain distribution system, reward adopters, and improve visibility forward of a full-scale deployment.

USD1’s rise, nevertheless, has not been with out scrutiny. The mission has drawn consideration as a consequence of President Donald Trump’s involvement, elevating issues amongst lawmakers about potential conflicts of curiosity.

Regardless of this, USD1’s market efficiency signifies robust investor confidence. The stablecoin’s fast progress suggests it might proceed to play a big position within the digital asset market. Nonetheless, its future will seemingly rely on each market dynamics and regulatory developments.